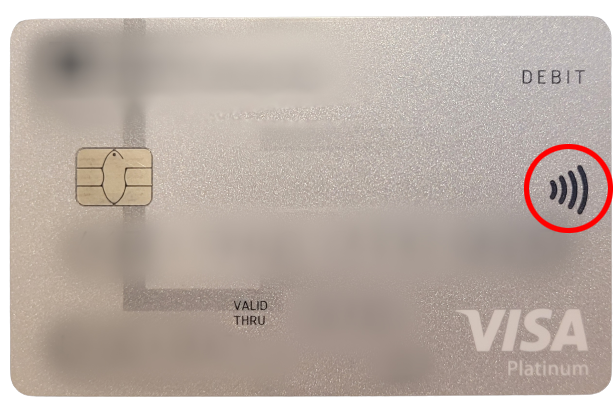

Tap to pay! You must have heard that before. If you have a little sideways wave logo (see red circle on the image) on your credit card, you can simply tap your card on the merchant terminal to pay.

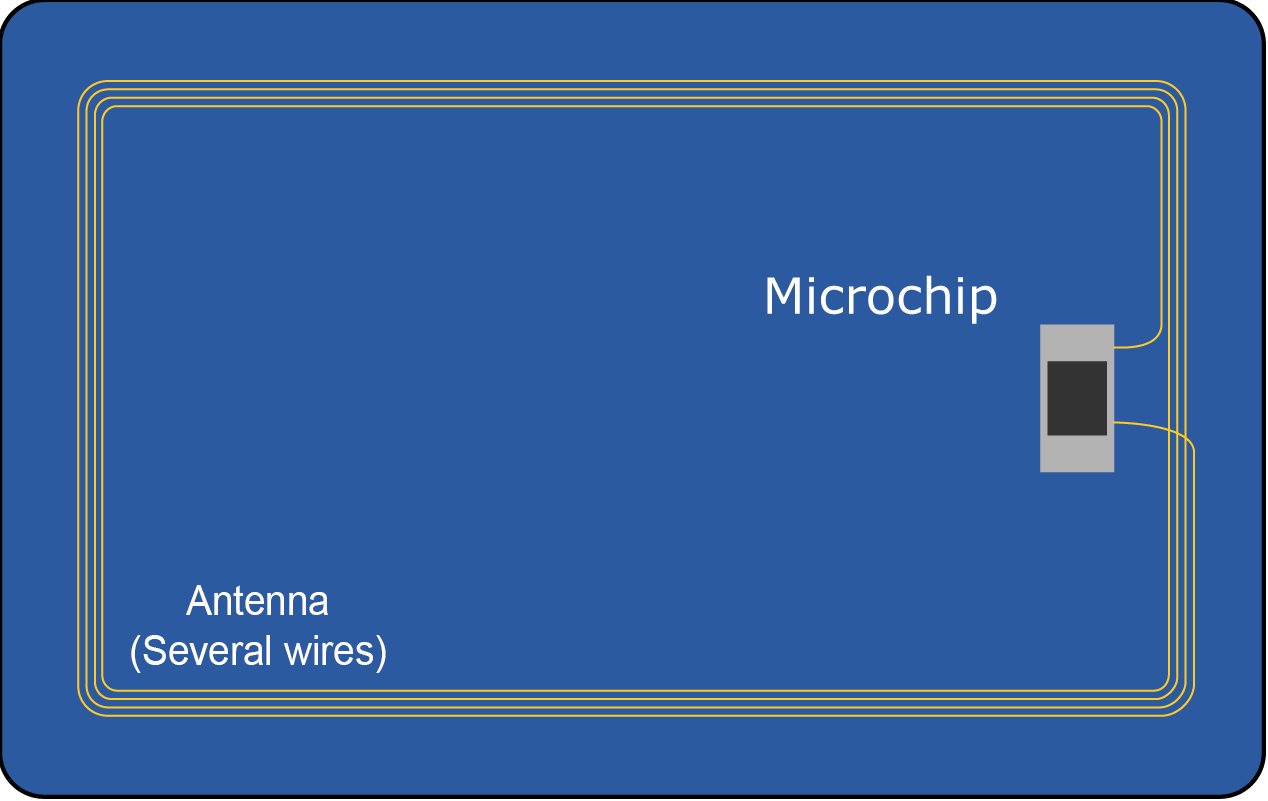

This payment method allows you to make contactless transactions using Radio Frequency Identification (RFID) technology. The technology consists of:

-

- 📡 A microchip inside the card. It contains information such as the card number. This is different from the EMV chip visible on the outside of the card.

- 📡 An antenna inside the card which sends information to the sales terminal. This is made up of several wires.

- 📡 An antenna in the terminal device to transfer and read information located on the chip.

These contactless credit cards make our lives easier, but how safe are they to use?

Technically, electronic pickpockets with skimming devices can pick up your card’sRFID signal and steal your money. In Europe, contactless purchases are limited to a certain amount to limit theft risks. Retailers have also created a market for RFID-blocking wallets.

How do these wallets work, and do you need one?

Quick Guide: How to Use a VPN in 3 Easy Steps

- Sign up to CyberGhost VPN. It’s fast and easy.

- Select a server from your country. Your bank website will work best in its home country.

- Access the website or app you want!

What Does “RFID-Blocking Wallet” Mean?

An RFID-blocking wallet uses a layer of carbon fiber or aluminum to block the electromagnetic signal emitted from your card. The wallet acts like a Faraday cage. It creates a barrier and cancels out electromagnetic signals. Whether you’ve owned a contactless payment card or not, the market for it has grown rapidly.

Do I Need to Worry About RFID Protection?

While it’s always a good idea to safeguard your wallet, the danger of contactless credit card thefts is overblown. Here’s why:

-

-

-

-

- Criminals with a reader need to be very close to scan your card.

- The theft is a time consuming hit-or-miss for criminals. Their victim might not even own a contactless card.

- The RFID chip only transmits the card number. Additional information needed for online transactions, such as the expiration date or security code, can’t be scanned.

- RFID cards now use encrypted one-time codes for each purchase.

-

-

-

All this means it’s not really worth it for scammers to skim RFID cards. Still, you should keep a close eye on your online finances and RFID scams are the least of your worries.

How To Shop Online Safely

CyberGhost VPN hides your IP address and masks it with one from its servers. Cybercriminals won’t be able to detect your real location, and steal your information. Use CyberGhost VPN for peace of mind when you’re online shopping, banking, or surfing the net.

Worry Less, Shop More

Love online shopping, but worried about your security? According to the FBI, online shoppers lost nearly $2 billion from skimming and related online theft in 2020 alone.

Use a VPN when you shop online to prevent cybercriminals from targeting you. CyberGhost VPN encrypts your internet traffic with a special key so no one sees your online activity. It’s nearly impossible for anyone to decode the key. CyberGhost VPN uses military-grade 256-bit AES encryption, the best kind available.

Thanks to this encryption, you can shop online confidently and securely.

Protect Yourself When Traveling

Just like your wallet, your data is at risk when you travel. You never know who could be lurking on the free airport wifi, waiting to hit you with a MitM attack. Cybercriminals trick the network system to intercept your connection and steal your data. That’s why you need to protect yourself with a VPN.

CyberGhost VPN includes the latest VPN Protocols to keep your data safe. These protocols are guidelines for how you connect to the VPN server. Each protocol has its advantages, so CyberGhost VPN lets you choose the best one for you.

Access Online Banking Worldwide

Want to access your online banking platform securely from abroad? Some banks restrict access to users located in a foreign country.

A VPN can overcome this barrier. You can change your IP address and disguise your location. CyberGhost VPN has thousands of servers in 91+ countries, so you’re likely to find an uncrowded server in the country you want.

Download and connect to Cyberghost VPN to safely manage your finances from anywhere in the world.

Connect Up to 7 Simultaneous Devices

Staying safe online is just as crucial on mobile devices as on desktops. That’s why CyberGhost VPN protects your connection on nearly any device.

CyberGhost VPN has apps for all major devices including PC, Mac, iOS devices, Android, and more. Your subscription also supports up to 7 simultaneous connections. That means family and friends can also benefit from the security of a VPN.

Enjoy Enhanced Online Privacy

Your data is valuable, which means that cybercriminals aren’t the only ones looking to spy on you. Your Internet Service Provider (ISP) and possibly your government are eager to keep tabs on what you do online.

CyberGhost VPN has a No Logs policy, so we don’t keep track of your activities. Since our headquarters are in Romania, which isn’t a part of the five eyes alliance, we don’t have any requirement to report on you. CyberGhost VPN keeps your data safe so you can finally enjoy improved privacy online.

Whether you’re traveling or at home, cybercriminals are a real danger. VPNs give you a secure way to avoid cyberattacks and keep shopping or banking from anywhere. Get CyberGhost VPN to get back and enjoy the best part of online shopping- staying in your pajamas!

FAQ

RFID-blocking material blocks your card’s electromagnetic signal. For example, an RFID-blocking wallet uses a carbon fiber or aluminum layer to disrupt the signal and create a “Faraday cage.” RFID-blocking only works on cards with RFID technology. Next time you pay by card online, consider using a VPN to avoid falling victim to cybercriminals.

No. In most cases, it’s not necessary because a thief would have to get very close to your card with no obstructions to steal from it. Still, it’s important to secure your financial information, especially online. CyberGhost VPN is a great way to stay out of harm’s way when you surf online.

Possibly. While aluminum foil may block the RFID signal, the signal itself requires close direct proximity to the sensor to work. More often than not, aluminum foil isn’t necessary.

It’s easier for cybercriminals to find sensitive information like your credit card details online. You should secure your connection with a VPN. Try CyberGhost VPN, backed by a 45-day money-back guarantee.

Since the latest cards only work within close proximity (a few inches or centimeters), distance is usually enough to block the signal. Cloth barriers like your purse or wallet can further reduce it. If you’re worried, RFID-blocking wallets will definitely block the signal.

Still, cybercriminals can target you easily by leveraging your digital identity. Thankfully, VPNs like CyberGhost protect your identity online.

While scammers are a real threat, they don’t rely much on RFID. Other ways are easier and more convenient. Cybercriminals now target shoppers more than ever because online purchases offer an opportunity to get information at the point of sale.

Use CyberGhost VPN to protect your connection with a secure tunnel, so no one can intercept data transferred between you and the retailer.

No, RFID wallets don’t ruin credit cards. Still, it’s essential to keep your credit cards separated in any wallet. You should avoid placing them near any magnets, which can erase the data on the magnetic strip.

Virtually, VPNs are the best thing for your wallet and peace of mind. CyberGhost VPN’s support team stands by 24/7 in case you ever need us!

Leave a comment

Carolyn

Posted on 20/03/2023 at 02:31

Two of my credit cards have been hacked

so I’ve had to get new ones? Is there anything I can do to help this from happening again

Ghostie

Posted on 21/03/2023 at 13:15

Hi, Carolyn,

That sounds like a lot of trouble, we’re sorry you’ve been through this twice.

Our advice would be to stop giving your credit card information unless absolutely necessary, including for online transactions.

Revert to cash wherever possible and then try to resume your regular payments one by one, with a couple of days distance in between so you can assess whether that specific transaction might have led to some foul play.

Sometimes, identity thieves can install card readers on unsuspecting shops and even ATMs, so take extra caution with any places that require a card swipe.

Hopefully, being extra cautious with your credit card usage & details will help you determine where the problem lies.

Stay safe!

white_check_mark

eyes

raised_hands