Filing your taxes online is convenient, but it can expose you to scams and online fraud that lead to tax-related identity theft. Unfortunately, fraudulently-filed returns and stolen tax refunds are common this time of year.

Protecting your personal data is the key to avoiding tax-related identity theft.

In this article I’ll talk about some of the common scams to watch out for. I’ll also show you how to file taxes online securely and safely, even if you’re an expat living abroad. Some of my advice is specific to tax season, but the cybersecurity dangers and precautions you’ll read about apply to pretty much anything else you do on the internet.

The deadline to file your taxes is April 18. Make sure you do so safely. CyberGhost VPN is here to help you file safely. Stop cybercriminals and third parties with uncrackable 256-bit military-grade encryption for all your personal information.

Online Fraud is Everywhere

According to a 2021 Federal Trade Commission report, there are nearly 90,000 annual cases of tax-related identity theft in the US. It’s easy to become a victim unless you know what to watch out for.

Here are some of the most popular scams you may encounter during the 2023 tax season:

Phishing Emails

Phishing scams are getting more sophisticated and convincing. Identity thieves often send emails posing as the IRS that look legit and even have official IRS logos. They’ll ask for your personal and financial information, and maybe even your taxpayer ID PIN and password. Don’t give it to them! The IRS will never email you asking for that information.

Identity thieves are also still phishing with the Coronavirus pandemic. If you receive an email about a new COVID-19 economic stimulus payment, don’t open it. The federal government is no longer sending out stimulus payments.

Scammers might also send you pandemic-related emails that look like they’re from a trusted source, such as a colleague, bank, or even the IRS. If there’s urgency to the message and it’s trying to get you to open a link or attachment, it’s a scam. This type of targeted scam is known as spear phishing. Identity thieves often use it to steal client data from tax professionals.

Phishing SMS, Text, and Social Media Messages

If you receive an SMS message, text message, or social media message from the IRS asking for personal or financial information, delete it. Someone is trying to steal your identity. The IRS won’t contact you with those kinds of messages asking for your private information.

Fake Charities

Scammers are notorious for setting up fake charities to take advantage of your generosity – and then steal your identity. These scams may be disguised as natural disaster relief funds, aid for Ukraine, or anything else that might tug at your heart strings.

If you’re contacted by a charity asking for a contribution, be sure to research the organization before you donate. A charity should not ask for your personal information or a wire transfer. If they pressure you to donate on the spot, chances are they’re not legit.

You can check the status of a charity using the IRS Tax Exempt Organization Search tool.

Refund Recalculation

You know the phrase, “If it sounds too good to be true, it probably is”? You can apply that to this type of identity theft scam. If someone contacts you via email or text suggesting you’re due a bigger refund than you thought, it’s fraud. Don’t click the link. It will take you to a page where the scammer wants you to hand over your personal information.

If the IRS makes a mistake and you’re actually due a bigger refund, it will contact you by mail. Again, the IRS will never ask for your personal information via email or text.

Phone Scams

No, this isn’t online fraud, but it’s still worth a mention. Criminals have been making phone calls posing as IRS agents since before the internet was a thing. We all know we’re not supposed to give out our personal information to a cold caller – yet somehow this scam still works.

The IRS will never call you to threaten a lawsuit or arrest. It will also never call to ask for your personal information or taxpayer ID PIN. If someone calls you asking for these things or making threats, hang up.

Pro Tip: Be Proactive in protecting your data by using a VPN every time you connect to the internet. CyberGhost VPN hides your IP address and reroutes your data through a secure tunnel, so no one can see what you’re doing or steal your private information.

How Do I File My Taxes Online

There are three ways to file your taxes online in 2023:

- Use IRS Free File.

- Use online tax software.

- Hire a tax preparer.

Preparing to file your taxes is the same no matter which way you file.

Filing taxes never looked better.

Step 1: Gather Year-End Tax Information

You should have all your tax documents and information ready to go before you log in online or meet with a tax preparer. These include:

-

- ➡ Your social security number or Tax ID number.

- ➡ The social security number or Tax ID of everyone listed on your return.

- ➡ Employment documents, such as W-2s and 1099s.

- ➡ Investment documents.

- ➡ Interest documents, including savings accounts, mortgage, and student loans.

- ➡ Itemized deduction receipts, if greater than the standard deduction.

- ➡ Your bank account and routing number.

Visit the IRS website for a more comprehensive list of tax documentation and information you need to file your return.

Step 2: Protect Your Data

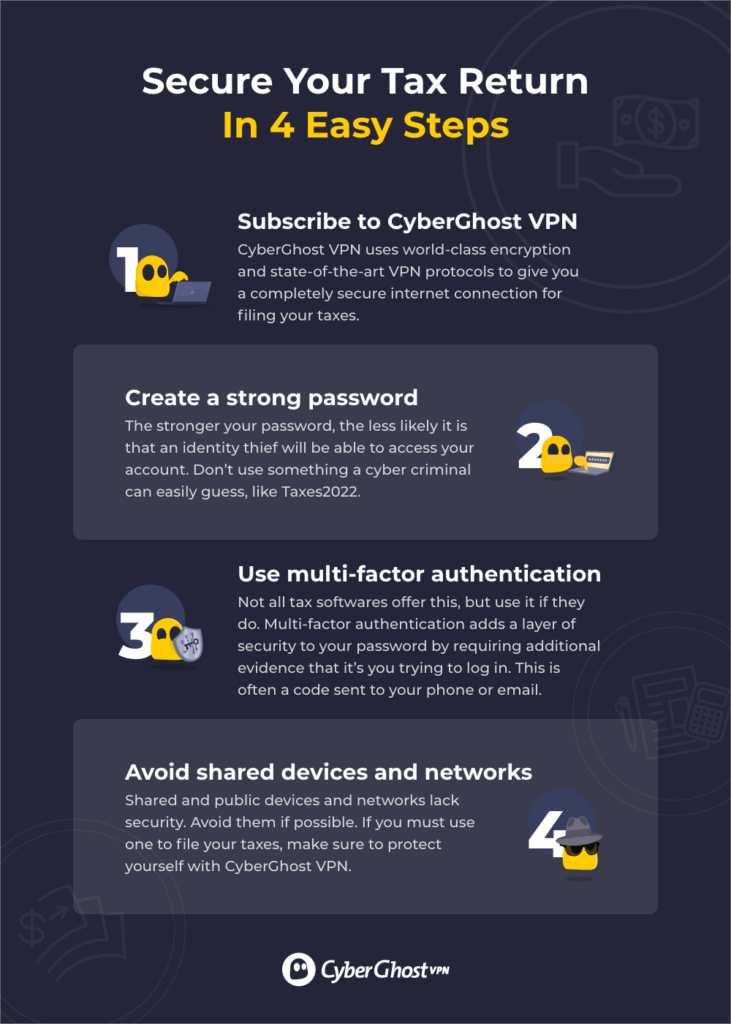

If you’re using IRS Free File or an online tax preparation software you need to protect your personal data from identity thieves.

Always create a strong password for your online tax accounts. Use multi-factor authentication and avoid shared devices whenever possible.

You should also subscribe to a secure VPN like CyberGhost to further protect your data. CyberGhost VPN uses military-grade encryption to keep your information private. We also have a strict No Logs policy that outlines why we don’t collect any of your data ourselves. That means bad guys can’t get in and we never track or share your information with anyone.

Public Wi-Fi networks are a playground for identity thieves, so we don’t recommend submitting your online tax return using one. If you have to use public Wi-Fi, CyberGhost VPN gives you a secure connection that keeps you completely protected. We’ve even got an automatic Kill Switch that will block all activity if your VPN connection ever drops for any reason.

Step 3: Prepare Your Return

👉 IRS Free File

IRS Free File is the cheapest way to file your federal tax return. As the name suggests, it’s free.

While anyone is free to use the IRS Free File fillable forms, the only guidance you’ll have is the IRS-published instructions. If you choose this method, make sure you’re fully comfortable filling out the forms and filing them on your own.

You can use Free File’s guided tax preparation if your adjusted gross income (AGI) is $73,000 or less. If you use guided tax preparation, an IRS partner site will answer simple questions, do all the math, and file your return for you. An added bonus of the Free File guided tax preparation is that some state tax preparations and filings are free as well.

IRS Free File is a good option if you have a straightforward return or you have experience filing your own paper taxes.

👉 Online Tax Software

Online tax software is the easiest way to file your taxes yourself. Simply choose a credible program and it will walk you through the step-by-step process to fill in the blanks and file your return. All you’ll have to do is enter the information you gathered at step 1.

Some tax softwares offer free or inexpensive federal filing for basic returns. That said, most charge for state returns and more complicated federal returns.

Online tax software is great for anyone with a fairly straightforward tax return.

👉 Tax Preparer

Filing your taxes with a tax preparer is the most expensive option, but it can also be the easiest. A good tax preparer will take the information you gather in step 1 and do all the inputting themself. They will also often find deductions and savings you may miss.

Using a tax preparer is a good idea if you’re self-employed or have a complicated return.

Step 4: Pay Tax or Collect Refund

The final step in filing your taxes with the IRS is to either pay your outstanding balance or collect your tax refund.

When you file using any of the three methods above, you will receive your refund as a direct deposit. This usually happens within three weeks. If you owe money, you can also pay directly from your bank account.

Pro Tip: Sending and receiving any financial information on the internet is always risky. Use CyberGhost VPN to keep your data–and your money–to yourself.

Filing US Taxes As An American Expat

If you’re an American living abroad, you still need to file a US tax return. That said, just because you have to file a return doesn’t mean you have to pay US income taxes. Many expats qualify for foreign earned income exclusion or a foreign tax credit.

If you’re a US citizen or resident alien living abroad in 2023 you may qualify to exclude foreign earnings up to $112,000. You may also be able to deduct costs for foreign housing.

If you earn more than $112,000, your foreign income will reduce your taxable US income. If you qualify for a foreign tax credit, that credit will also reduce your US tax liability.

The process to file your expat return isn’t much different than filing if you were in the States.

Most countries have tax preparers experienced with US expat returns as well as returns for their own country. If you have a complicated return, this may be your best (and only) option. Unfortunately, having someone prepare your expat US tax return can be very expensive.

IRS Free File is not an option for expats, but there are tax softwares designed for expats. If you don’t have an overly complicated return, these are a great option.

Make Sure You File Your Tax Return Safely

Filing your taxes online can be the safest and quickest way to get your refund. IRS Free File, tax software, and in-person tax preparers all have their benefits. They also come with risks. No matter what method you use, you should take the proper precautions to avoid fraudsters and protect your identity.

Email, text messages, and social media are prime avenues for the phishing scams. Identity thieves may also approach you with bogus charities or promises of a bigger tax refund than you expect. Don’t believe them! And if anyone ever calls or reaches out asking for your personal information, don’t give it to them!

Avoiding scams aside, the best way to protect yourself anytime you get online, and especially when you file your taxes, is to use a secure VPN like CyberGhost. CyberGhost VPN encrypts your data and masks your IP address to keep your personal information safe.

FAQ

Whether you’re living in the US or you’re an expat abroad, you need to file an IRS tax return once you cross certain income thresholds. If you’re an employee, you’ll have to file when your income is more than the standard deduction.

If you’re not sure whether you need to file, use the IRS Interactive Tax Assistant to find out. Whatever your IRS status is, you need to protect your private information online. CyberGhost VPN will keep you safe. We use military-grade encryption to stop cybercriminals, government spyware, and other third parties from getting to your data.

To file your taxes you’ll need social security numbers for everyone listed on your return, plus all year-end income documents from your employer, like W-2s and 1099s. You’ll also need investment interest documents, Child Tax Credit payments, and any other year-end tax documentation you get.

You’ll give the IRS your bank account and routing numbers to receive payment. Make sure you’re using a safe connection and trusted device so your information isn’t stolen – not to mention your money. Connect to CyberGhost VPN on any device to keep your data private and secure, even on public Wi-Fi.

Anyone can use IRS Free File, but you can only use Free File guided tax preparation if your adjusted gross income (AGI) is $73,000 or less. If it’s more, you can use the IRS Free File fillable forms to submit your return. Free File provides some security, but you need more to stay safe online.

Use CyberGhost VPN to hide your IP address and protect yourself from cybercriminals and third party surveillance. Upgrade to our CyberGhost Security Suite for the highest level of protection against viruses, malware, and cyberattacks.

IRS Free File gives you two options for preparing your own tax return–using free fillable forms, or choosing an IRS partner site for guided tax preparation. You’ll need the same private data and documents you’d need for any other filing method, so you need to protect your information.

You might be tempted to use a free VPN for Free File. Don’t. Free VPNs have poor security and some even sell your information. Try top-notch VPN protection with our 45-day money-back guarantee. We’ve even got a strict No-Logs policy, so we’ll never track or store what you do online.

Yes. Cybercriminals are always looking for ways to collect your personal data. Unsecure networks and shared devices can lead to data breaches, identity theft, and stolen tax refunds.

Get CyberGhost VPN to make sure your data is secure. We protect your digital identity so you retain your privacy and your data is always safe. Contact our customer support team 24/7 to learn more about how our VPN helps you avoid online fraud.

Leave a comment