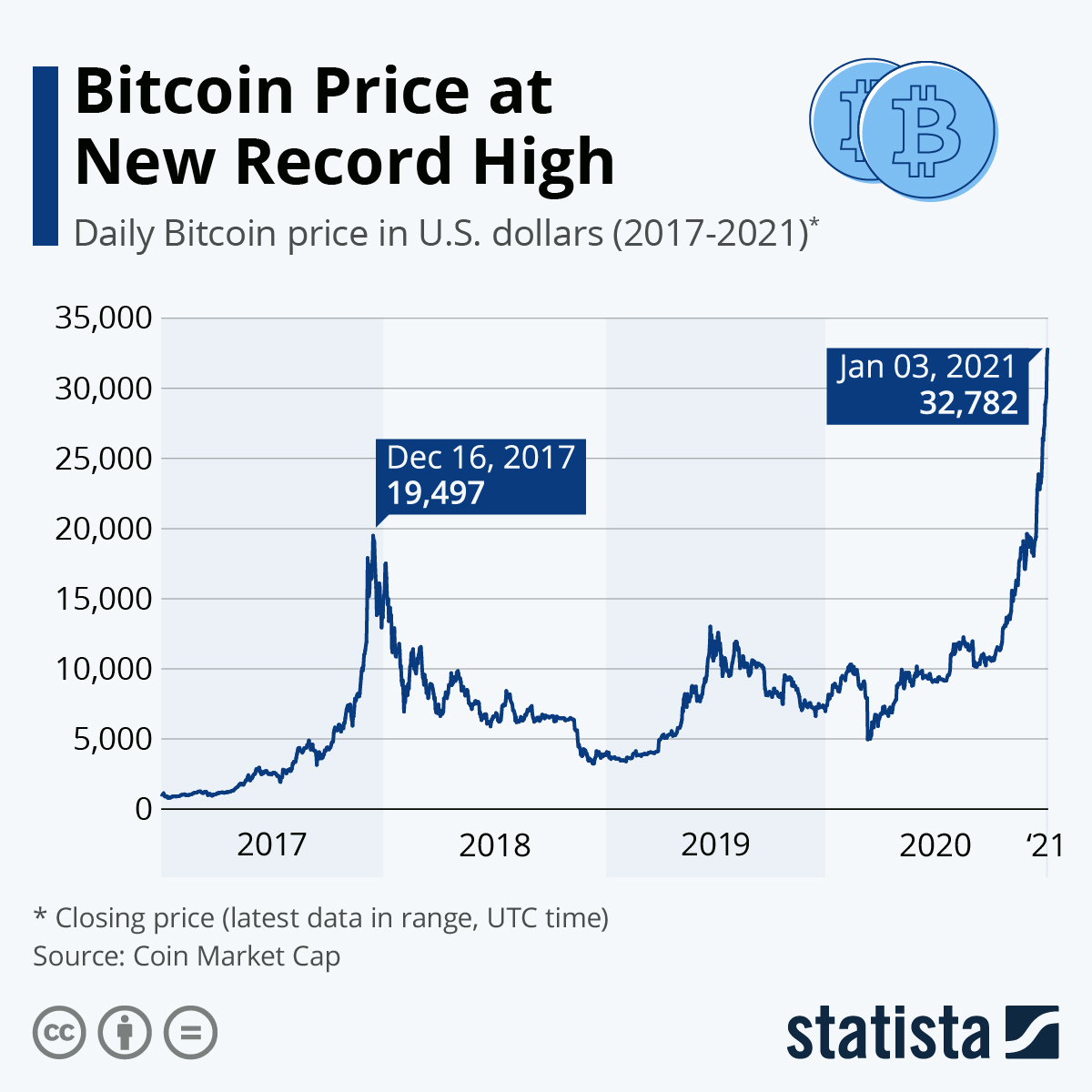

0,8$. 19,497$. 32,782$. These have all been Bitcoin prices over the years.

The cryptocurrency frenzy started in 2009, along with Bitcoin’s launch, and today there are over 1,000 cryptos available online.

Many finance specialists believe digital currency is here to stay. And if you’re attracted by the idea of owning a digital currency that’s not governed by the traditional banking system, you might also be tempted to open a crypto wallet.

But there are some things you should know about keeping your transactions secure. Let me tell you all about it.

You will find more infographics at Statista

How cryptocurrencies operate

If you’re new to this world, a cryptocurrency is a digital currency that works as a medium of exchange.

The individual (or team) known as Satoshi Nakamoto, who invented this payment method, created a peer-to-peer electronic cash system using blockchain technology. Unlike a typical database, blockchains store data in chained-together blocks that can’t be deleted.

Another element of cryptocurrency is mining.

Mining is performed by high-performing computers that solve complex computational math problems to produce cryptocurrency. People, called miners, manage and control the process. They make the payment network trustworthy and secure by verifying its transaction information.

Miners are awarded cryptocurrency for their efforts whenever they add a new block of transactions to the blockchain. Here’s how a cryptocurrency transaction goes:

- A transaction is sent to the peer-to-peer computer network.

- The network confirms its validity.

- Once verified, the transaction is clustered into blocks.

- Blocks are chained together in the history of all permanent transactions.

- The transaction is complete.

This is what happens behind the scenes when cryptocurrency holders use their crypto wallets to transfer sums from one public address to another. Each transaction leads back to a unique set of keys. Whoever owns them has the money, just like whoever owns a bank account has the money in it.

The transaction amounts are public. But, because of the encryption system, it is not clear who made the transaction. Unlike other payment options, crypto payments can’t be reversed. Transactions are permanent, and people can’t track their tokens once they’re gone from their wallets.

Crypto has a long way to go before it becomes mainstream, but you can already pay for plenty of goods and services with Bitcoin or other tokens.

Hackers are targeting crypto-transactions

Like plenty of other digital activities, cryptocurrency transactions attract hackers. Given some tokens’ rising value, they could end up with impressive amounts of money after successful attacks.

Here are some of the biggest cryptocurrency threats.

ICO fraud

Initial Coin Offerings (ICOs) are events where companies attempt to raise capital by selling a new cryptocurrency. Investors may purchase it, hoping the value of the cryptocurrency will increase, or later exchange for that company’s services.

ICO frauds are quite common, so approach any new cryptocurrency with caution.

Crypto-jacking

If an evildoer hacks you and installs mining software on your device, that’s crypto-jacking.

And because mining cryptocurrency takes a lot, you’ll probably notice a decreased performance. If that’s the case, make sure you’re not the victim of crypto-jacking or some other type of spyware.

Phishing attacks

Cryptocurrencies are no stranger to phishing attacks.

For example, in 2020, hackers compromised 130 Twitter accounts to promote a Bitcoin scam.

The fake tweets asked users to send bitcoin to a wallet. In return, the star would double the money and return it as a charitable gesture. Compromised accounts included those of well-known public figures such as Barack Obama, Bill Gates, Jeff Bezos, and Warren Buffett.

To make sure you’re safe, learn the telltale signs of phishing emails.

A VPN can help protect your crypto funds

One of the most significant benefits of cryptocurrency used to be its absolute anonymity. But now, as authorities around the world are starting to regulate the industry, many crypto exchanges are implementing Know Your Customer (KYC) and Anti Money Laundering (AML) verification steps.

So, if you want to make sure your details stay safe and no snooper gets access to them, you need proper tools, like a VPN.

Because a VPN encrypts your data, hackers won’t be able to spy on your transactions. It also hides your IP address and prevents persistent tracking, so your physical location doesn’t get linked to your blockchain wallet address.

To supercharge your privacy, you can also opt for a Dedicated IP address and use it for your wallet.

Plus, our privacy-oriented VPN doesn’t store any logs so, not even us, as a VPN service, can see your crypto activity.

What about you? Do you use crypto? Is it more for fun, or do you think this is the future of money? Let me know in the comments below.

Leave a comment

Skyy tracker

Posted on 14/03/2022 at 12:10

very good information about crypto tokens

Adina Ailoaiei

Posted on 14/03/2022 at 16:34

Glad to hear you enjoyed reading, Ghostie.